Over the past decade, the landscape of financial access has shifted dramatically. In 2024, the World Bank’s Global Findex report revealed that 79% of adults globally now have a financial account, a leap from 62% in 2014. This remarkable trend reflects decades of effort by governments, fintech innovators, and community organizations working to connect the unbanked to formal financial systems. Yet, 1.3 billion adults still lack an account, illustrating the pressing need for targeted strategies that can reach the most marginalized populations.

Financial exclusion has profound social and economic consequences. Without access to savings, credit, and secure payment systems, individuals are vulnerable to exploitation, unpredictable income shocks, and missed opportunities. Closing this gap is not only a moral imperative but also a catalyst for sustainable growth. By expanding access, societies can unlock the creative potential of entrepreneurs, strengthen social safety nets, and build resilience against crises.

The progress in developing economies is particularly noteworthy. In low- and middle-income countries, account ownership now stands at 75%, up from just 55% in 2014. This represents an 80% increase since 2011, driven by technological innovation and policy reforms. However, the journey is uneven: 650 million unbanked adults are concentrated in eight nations, including India, Nigeria, and Pakistan, highlighting regions where targeted interventions could yield outsized benefits.

Gender disparities remain a challenge despite marked improvements. The female account ownership gap has narrowed to 5 percentage points in 2024, down from 9 points a decade ago. Yet in regions like the Middle East and North Africa, women are still 14 percentage points less likely than men to have an account. Addressing cultural norms, regulatory constraints, and infrastructure gaps in these areas is crucial to achieving true gender equity in financial services.

Formal savings are on the rise as well: 40% of adults in developing economies saved in a financial account in 2024, marking a 16-percentage-point increase since 2021. In Sub-Saharan Africa, savings rates climbed by 12 percentage points, underscoring the role of formal accounts in enhancing financial resilience. Yet nearly half of adults in these regions still lack sufficient buffers to cover a month’s expenses.

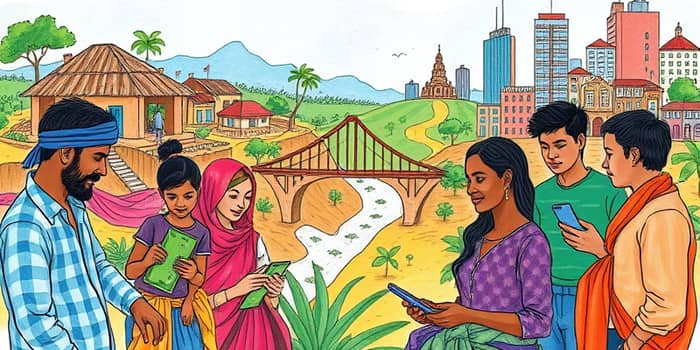

Digital finance has emerged as a game-changer in reaching underserved communities. Mobile-phone technology and internet connectivity have fueled the rise of mobile money, bridging geographical and infrastructural barriers. Today, around 900 million unbanked adults own a mobile phone, with more than half of them using smartphones to access financial services.

These innovations have not only expanded access but also reduced costs and enhanced transparency. By leveraging bank partnerships and regulatory sandboxes, fintech startups are creating tailored solutions for smallholder farmers, female entrepreneurs, and migrant workers, ensuring that financial products meet the needs of the next billion users.

Despite advancements, significant barriers persist. Mobile phone ownership remains lower among adults with limited education, and 16% of the global adult population still lacks any phone access. Financial literacy gaps leave many vulnerable to predatory lending and fraud, while fragile states often lack the infrastructure and regulatory capacity to support digital platforms.

Governments, multilateral organizations, and private sector partners must collaborate to strengthen digital infrastructure, enforce consumer protection, and invest in skills training. Community-based initiatives—such as financial education workshops and local agent networks—play a critical role in building trust and ensuring safe adoption of new services.

Achieving universal financial inclusion requires collective will. Stakeholders across sectors must unite to design inclusive products, expand digital literacy, and advocate for supportive policies. Success stories from South Asia, Sub-Saharan Africa, and Latin America show that coordinated campaigns can dramatically reduce exclusion, empower women, and drive economic growth.

By taking these steps, individuals and organizations can help close the divide and build a world where everyone has the tools to manage risks, seize opportunities, and achieve financial well-being. The path toward inclusion is challenging but achievable when stakeholders commit to innovation, equity, and collaboration.

As we look to the future, let us celebrate the gains made and resolve to reach those still left behind. Financial inclusion is more than an economic goal—it is a foundation for human dignity, opportunity, and shared prosperity. Together, we can ensure that every person, regardless of geography or circumstance, has the power to save, borrow, transact, and transform their lives.

References