In a rapidly evolving world economy, emerging markets stand as vibrant beacons of potential, drawing global attention from investors, entrepreneurs, and policymakers alike. These dynamic economies, spanning from the bustling streets of Mumbai to the modern industrial parks of Vietnam, offer a unique blend of youthful energy, innovative drive, and transformative ambition. As they navigate the path from developing to developed status, they reshape global trade patterns, spur technological leaps, and foster social progress. This article delves into the heart of emerging markets, unpacking their defining traits, examining the forces propelling their growth, and offering practical guidance on capitalizing on their promise while mitigating inherent risks.

At their essence, emerging markets are economies in transition toward higher income. They are nations that have embarked on a trajectory of industrialization, moving from reliance on agriculture and local commerce toward diversified manufacturing, services, and global trade integration. This transition brings both challenges and opportunities, as these countries work to establish robust financial systems, improve infrastructure, and foster human capital development. Over decades, the concept has expanded to encompass a diverse group of nations across Asia, Latin America, Eastern Europe, and Africa.

What unites emerging markets is a set of shared characteristics that define their potential and shape their trajectories:

Emerging markets are the powerhouse of global GDP growth, contributing over 66.4% of the expansion seen between 2015 and 2025. In 2025 alone, they are expected to account for 51.0% of total global output, hosting more than 4.3 billion individuals. By contrast, advanced economies are projected to grow at around 1.5%, underscoring the accelerating shift of economic gravity toward Asia, Latin America, and parts of Eastern Europe. This momentum reflects longstanding structural changes, including urbanization, capital deepening, and the scaling of domestic enterprises.

Regionally, South and Southeast Asia shine as standout performers. India leads with an impressive 6.2% GDP growth forecast, while Vietnam, Indonesia, and the Philippines ride waves of industrial expansion, digital infrastructure upgrades, and strategic foreign investment. Beyond Asia, Latin American markets like Peru and Chile have demonstrated extraordinary growth, with anticipated rates exceeding 10% in 2025. Even traditional oil-exporters such as Saudi Arabia and the UAE are diversifying into non-oil sectors, seeking to harness the full breadth of their capabilities.

Such figures reflect more than statistics; they signal the transformative power of large, low-cost labor force dynamics, robust consumer markets, and evolving financial systems. For global investors and multinational firms, emerging markets are not peripheral—they are central to future growth strategies and long-term portfolio diversification.

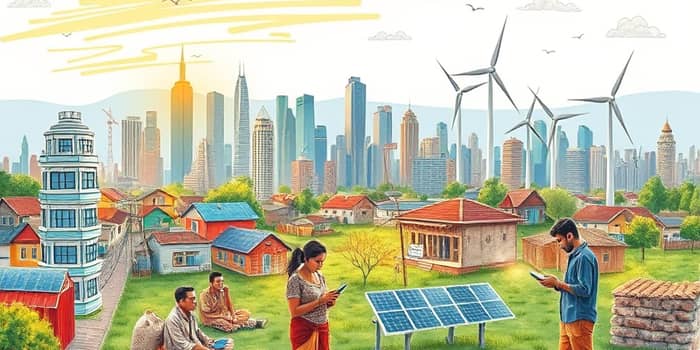

The year ahead promises a wealth of possibilities as emerging markets embrace new technologies and sustainability agendas. Four key areas are poised to deliver outsized returns and social impact:

Digital transformation remains at the forefront, with widespread mobile internet adoption empowering millions to participate in e-commerce, mobile banking, and telemedicine. In regions like Southeast Asia and sub-Saharan Africa, where traditional infrastructure lagged, digital platforms have enabled consumers and small businesses to leapfrog legacy models, creating a fertile ground for fintech startups and digital payment ecosystems.

Simultaneously, the rise of sustainable development initiatives is attracting global capital into renewable energy, waste management, and green finance. Brazil’s investments in biofuels, India’s solar energy auctions, and Kenya’s geothermal ventures exemplify how sustainability is becoming economically viable, socially beneficial, and environmentally imperative.

Robust domestic demand provides another engine of expansion. As middle classes swell across India, China, and Latin America, consumption of electronics, automobiles, healthcare services, and quality education grows in lockstep. Governments are channeling fiscal spending into infrastructure projects—from highways to smart cities—catalyzing private sector investment and job creation.

Finally, favorable external conditions, including resilient commodity prices and moderate interest rates in advanced economies, support a continued flow of foreign investment. Despite occasional market jitters, emerging markets have demonstrated remarkable resilience to risk-off shocks, buoyed by stronger fiscal positions and greater monetary policy flexibility.

Yet, the path forward is not without obstacles. Investors and businesses must remain vigilant to an array of risks that can disrupt growth trajectories:

Addressing these challenges requires calibrated policies, transparent institutions, and a commitment to equitable progress. For businesses, this means conducting thorough geopolitical risk assessments and engaging proactively with local communities and governments.

To thrive in emerging markets, organizations must blend ambition with humility, pairing bold vision with deep local understanding. Key strategies include:

By aligning commercial objectives with long-term societal goals, investors can unlock shared value, driving profitability while contributing to educational empowerment, healthcare access, and environmental stewardship.

The rise of emerging markets is a testament to human resilience and innovation, a collective journey of nations uplifting billions from subsistence toward opportunity. While the road is strewn with hurdles—from trade disputes to climate imperatives—the overarching narrative is one of hope and progress. As digital ecosystems expand and sustainable ventures flourish, emerging economies will continue to reshape global dynamics, offering fresh avenues for growth and collaboration.

Investors, entrepreneurs, and policymakers are called to action: to embrace the promise of emerging markets with informed optimism, strategic foresight, and unwavering commitment to inclusive prosperity. In doing so, they will not only capture economic gains but also become catalysts for sustainable development and social transformation across the globe.

References